$CRM: The Activist Quintet Won the Battle, but Benioff Won the War!

Salesforce.com went public in 2004 at a $1.1 billion market cap or the equivalent of $4 per share and 275 million shares outstanding. In its first decade as a public company the stock went up 15-fold from $4 to $60. Since 2014, the stock has tripled for a total gain of 42x your money from IPO to 2023. The share count via SBC (stock based compensation/options) and acquisitions has gone from 275m at IPO to 1 billion currently or a jump of 3.6x. At times, Marc Benioff has been proclaimed a serial spender, serial acquirer while being loose and fast with investor capital. In fact, we recently learned $CRM has been paying Matthew McConaughey $10m per year to do nothing but occasional commercials. It is great to see the company finally find religion on spending and now projects operating margins to go from 22% to 30% in the next 2-3 years. Thank you activists! I can’t calculate exactly the average cost to the five activists in their pursuit of change at $CRM, but maybe its about $150 to $185 or a 23% gain. Not bad, but its no 42x Benioff made for investors since IPO.

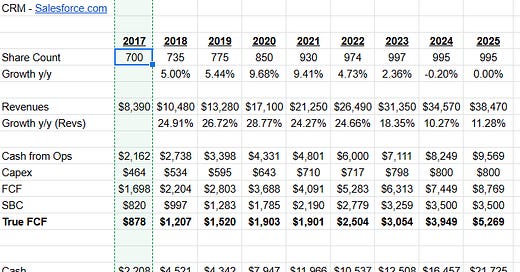

Do not get me wrong. Activists while pursuing their own self interests, typically do well by other shareholders by pointing out mismanagement and pointing eyes on change for all involved. Would Benioff have changed his spending ways and targets much higher operating margins this quickly? Probably not. Is it a bit too little too late? Yeah, unfortunately it is. Let’s review for a moment their road to $186 billion in market capitalization using 2017 thru the present. Interestingly, cash per share on the balance sheet peaked at $10 and widdled negative with their acquisition of Slack. In 2022, after 18 years of being a public company, CRM had 0 net cash on their balance sheet but was a $26 billion revenue company generating about $2.5 billion in real free cash flow per year.