Earnings season is mostly over. Sure, there will be some good fireworks to trade with the below list, but the market and index moving reports are mostly behind us as we enter the second week of May. Also, the Fed rate cut debate seems mostly well understood with 1-2 penciled in (WIRPS shows 1.8 cuts by December 2024) by the futures markets. The economy remains resilient albeit slowing a bit. Nvidia reports on May 22nd and is likely the tone setter for the summer months. It used to be said “so goes Apple, so goes the market” given its large percentage representation in the QQQ (8.08%), SPY (6.18%) and DIA (3.11%). These days I would argue Nvidia, at 5% and 6% of the SPY and QQQ respectively, plays a larger role in risk appetite than Apple does given the sheer volatility in the stocks and their expected business momentum.

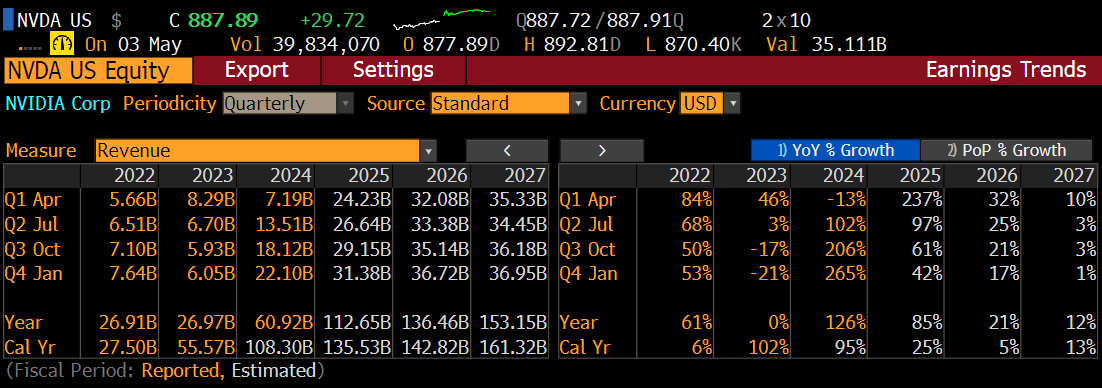

So, here is the NVDA set up on their spectacular revenue ramp since the AI spend frenzy started. A couple billion in sequential growth per quarter ahead……

How about the capital spending plans by the hyperscalers…….