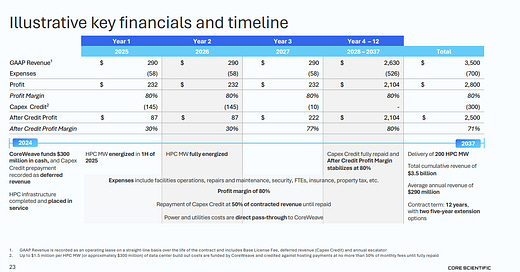

It is no longer a mystery to the markets that the bitcoin miners are a very quick, cost efficient way to power up AI data centers. Core Scientific, $CORZ, has bagged the first elephant, CoreWeave (private) with a 12 year deal which was structured rather smartly as you can see below.

CORZ did not want to get into the cash intensive capital spending game (if you build it, they will come) but rather is giving CoreWeave capital spending credits in the first three years equally $300m against their revenues. This leaves CORZ with a tidy profit in the first couple of years at $87m after all expenses and it jumps to $222m in year three and thereafter. With the upsizing of the contract it appears the company could be earning $300m per year starting in year three (2028). However, CORZ has approximately 430 million shares out, so the market cap is already $4.7 billion! The build out is expected to begin in the first half of 2025 (not sure why not much sooner). CoreWeave has raised significant debt (over $7 billion to buy GPUs) and recently is expected to do an equity offering with $23 billion as its valuation. On its face, you can be skeptical of a one customer cash flow machine and even worry a bit about the business model of CoreWeave which rents their compute power in some of the ways Microsoft or Amazon do with Azure and AWS. For the purposes of this article, let’s assume CORZ has struck a terrific deal and will cash flow $300m in a few years. Plus, they are the largest or amongst the largest BTC miners by amounts mined per month. Let’s guesstimate the core BTC mining business is worth $1.5 billion, you are left with around $3.2 billion in value for the HPC business. With $300 million in cash flows expected, the near 10% yield would seem very attractive, assuming execution goes smoothly and CoreWeave does “well”.