META: What CPMs are Telling Us

META: Go Back to See the Future

On February 1st, 2023, META reported their fourth quarter of 2022 earnings which showed revenues down 4% year over year and EPS excluding one-time restructuring items around flat. The company guided typical revenue seasonality for the 1st quarter and hinted that 2023 would be the Year of Efficiency. Operating expense and capital spending cuts of around $5 billion and $3 billion, respectively, were a small step in the right direction for a company that had been spending like drunken sailors. On February 11th, 2023, we wrote about the earnings power at META ahead given normalized EPS ex one-time restructuring charges from 4Q and the potential reduction or elimination of Reality Labs losses. Our thesis was that headwinds (IDFA privacy top line pain, Reels Monetization, bloated costs and RL losses) would turn into tailwinds for a stock trading at a low 8x EV/EBITDA on 2023 projections.

On March 14, 2023, Mark Zuckerberg shared with META employees his "Year of Efficiency" memo which outlined steps to be taken to reduce costs (leaner), streamline projects (flatter) and position the company for leadership in future technology revolutions in AI, short story videos (Reels) and, of course, still the Metaverse. Keeping score, EPS estimates for 2024 have since risen from $14 in February to $18 currently despite Reality Labs losses still in the $5 range annually! Reality Labs should be a 2024-2025 topic for spending cuts if no reasonable sized monetization realization occurs or seems visible. Then again, META has barely scratched the monetization surface on WhatsApp which they have owned since 2014. In summary, many levers still to pull (click to message is now a $10 billion revenue business). META’s stock has nearly doubled since February and now sits at 10x EV/EBITDA and a 5% free cash flow yield, both still attractive, all things being equal.

That is your brief, recent META history lesson, and the set up to the next leg in the META story and stock. This does not mean the next leg in the stock is up, it surely could be down. The stock closed at $338.23 on Friday, only 1% off its 52 week high. Celebrate its 2023 performance for a quick minute and then ask yourself if you would put new money into the stock at this price and valuation?

First,

META Platforms IS STILL a relatively cheap stock with top line levers to pull and costs that can be removed or grown slower than revenues to achieve EPS power much higher than current 2024 EPS projections of $18 per share.

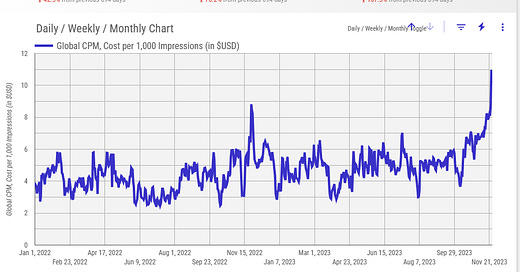

META Platforms IS NOT immune from economic cycles and IS NOT a recurring revenue model.

Advertising models have their limitations (ad budgets) and are not similar to recurring revenue businesses such as SaaS (software as a service). In an economic downturn, belt tightening leads to ad budgets cuts across most platforms, including online. Software businesses structured as subscriptions suffer differently with less customer additions, discounting, lengthier sales cycles and less NRR (net revenue retention or existing customer land and expand opportunities). As we enter the slowing phase of the economic cycle, we need to focus on the leading indicator metrics to get ahead of curve on what is next for the stocks in the advertising and software sectors. Often, multiple expansion and compression play an even larger role in stock performance than changes in earnings or cash flow expectations on an absolute basis.