MRVL setup

Betting with or against the charlatan?

Yep, let’s start by saying Matt Murphy, the CEO of Marvell Tech is a charlatan. In modern day terms in this stock market, in particular, a charlatan is a combination word salad story teller and one that clearly makes specious claims to fit whatever he or she is selling. Before we discuss, let me preface this by saying I am willing to trade a charlatan both long and short. It is just a matter of my own belief system of whether the markets will accept the stories being told as true.

Case in point, the re-bucketing effect at MRVL.

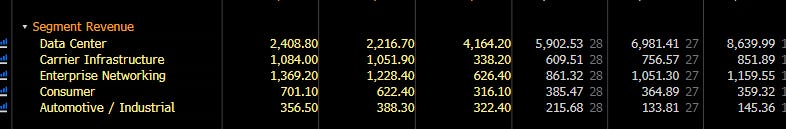

The first two columns below represent 2023 and 2024 revenues by end market. I remember laughing at how data center doubled in 2025 while carrier infrastructure was cut by 2/3 and enterprise networking by 1/2. Does anyone believe those end markets, even with a massive inventory build they probably encouraged, really dropped by that much? And, frankly, if it was an inventory correction, the snap backs don’t take three years to even approach prior levels. Did Matt, re-bucket revenues to call them AI/data center? I think so. After all, now he says the company is 75% data center (no room left to purge non DC buckets). Way back when, Marvell was a leader in enterprise networking (owning Galileo Tech) and was competing mightily with AVGO.

Fast forward, the debate of late had been will they keep Amazon Trainium or lose it to ALCHIP in Taiwan? Every conference call, if you are objective, has been a word salad explaining the strength of the relationship, the number of design wins for XPU attach (a new term but let’s say its possible) and more recently a switch to their strength not in custom asics but rather in fiber optics, now claiming data center to be 1/2 this category and growing fast. Do not try and pin down any historicals as they do not exist, just in Matt’s mind.

Ok, you get my skepticism. This does not mean the stock is a short. In fact, it might be a long, let’s get up to speed on Matt’s latest word salad he presented to Harlan Sur (the most gullible sellside analyst at JPM). On September 24, 2025, Matt set out to clear the air on expectations and set the table for….an acceleration in revenues, not in 2026 but rather 2027 and 2028. First, let’s remember how his Amazon (the only custom asic customer is doing of late with MRVL):