Name That Company!

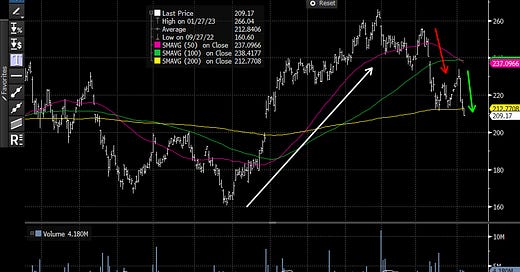

Company A: You could have made 66% from September 27th 2022 until January 27th 2023, annualized over 260%. From the peak, the stock has dropped 22% and is down 13% in 2023. Also, this stock has now crossed below its 200 day moving average. Consensus EPS estimates have gone up about 14% since September.

Company B: You could have lost about 12% from September 27th 2022 until the stock bottomed on November 4th. Then, being long, you could have made 24% from those lows before nearly re-testing (a 17% drop) them again in early January. Then, this was followed by a 32% rally to Thursday’s closing price and the stock is up 22% in 2023. Also, this stock is now 17% above its 200 day moving average. Consensus EPS estimates are down about 11% since September.

Any guesses on the names of the two companies? Without knowing more than the basic facts, historically, any thoughts on why stocks would follow such odd paths given their earnings projections trend? Some might cry foul as I am leaving out the P/E multiples and the relative EPS for context. Ok, Company A consensus EPS went from $13.90 to $15.90 and EPS growth the past few years has been 28% in 2022, 15% estimated for 2023 and 7% for 2024. Company B, on the other hand, has seen consensus EPS go from $11.92 to $10.70 since September and EPS growth the past few years has been 3% in 2022, 9% estimated for 2023 and 15% for 2024.

One appears to be accelerating and one is decelerating, correct? I am good with that narrative, albeit it is more subtle in that the growth rates aren’t so incredibly different on a 3 year stack. But, the free cash flow yields favor Company A with a 6.3% free cash flow yield and Company B with a 2.8% free cash flow yield. Company A trades at 13x EPS and Company B at 27x EPS. Any closer to guessing the two companies?

Before I make my point, please send your guesses on the names of the two companies, A and B, based on the above descriptions and the charts below. Any current “free” subs who guess correctly (directly send to robseducatedguesses@gmail.com) will receive access to the WhatsApp daily texts for 3 months. Reminder, we send out news, trade ideas, sell-side calls, pre-market high probability trades and intra-day commentary via WhatsApp. Also, follow us on twitter at @robeducated