S&P 500 at 4100: It's a Fine Line, A Very Fine Line

S&P 500 at 4100: It’s a Fine Line, A Very Fine Line

The stock market in 2023 has done the opposite of what most thought would happen. A sell-off in the first half of the year was supposed to be met with a rally in the second half. Instead, the market has taken some better recent inflation data, reasonable earnings updates and signs of a possible soft landing as a launch pad of resilience. Resilience is the phrase most keep using to describe this market. A wall of worry perhaps? Regardless, the more recent data (today’s PPI, CPI and recent jobs report) suggests inflation is stubborn and the WIRP has taken out any chance of a rate hike for 2023 and replaced it with peak terminal rate of 5.25% later this year (versus mid year). Yet, the stock market chugged along until today, literally until 2:30 today.

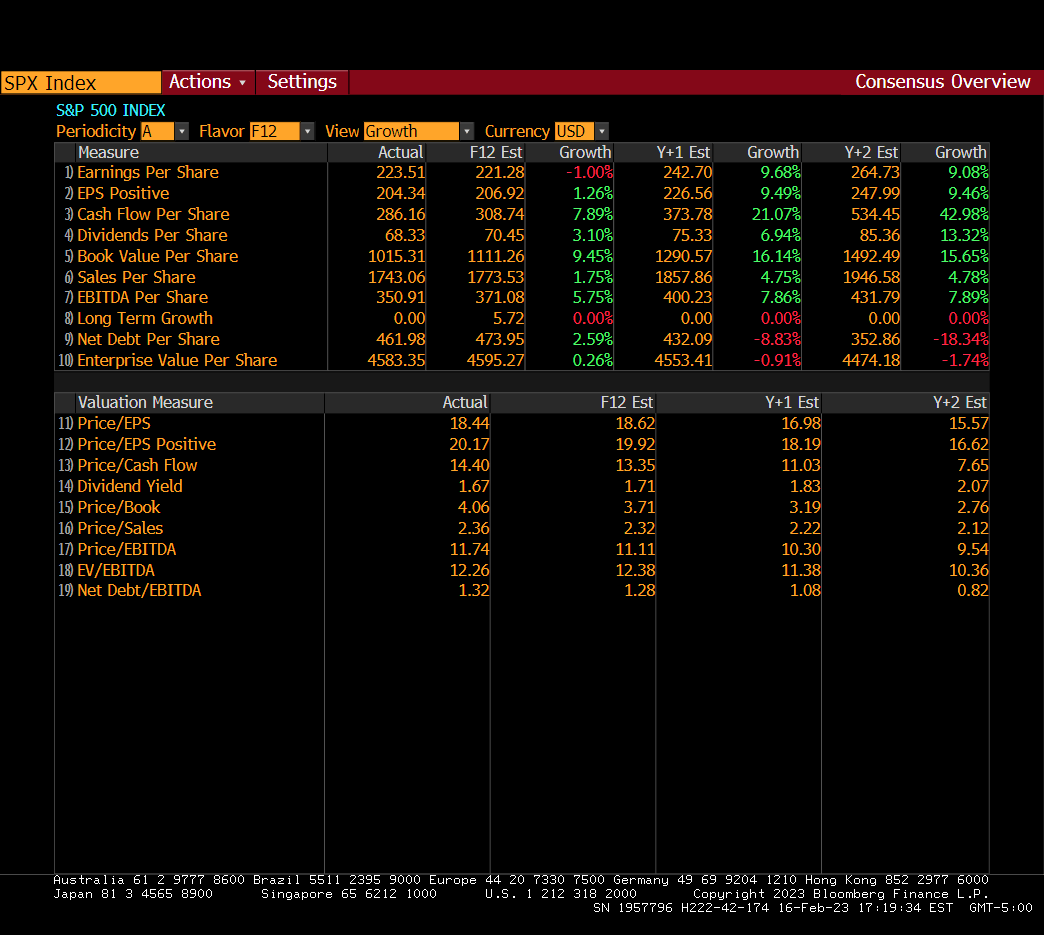

The bears will say S&P earnings look down 1% in 2023 right now at $221 per share down about $10 from late in 2022 projections. The market at near 19 times is certainly rich by any historical measures, especially with Fed Funds heading to above 5%. The current 2024 projections, always rosy a year out, show near 10% earnings growth, taking the multiple back down to 17x, also not particularly cheap. This argument holds water with us. It is helpful that 4Q earnings and 2023 outlooks seem “fine” given the circumstances right now. However, will they look fine in 2-3 months? Hard to say sitting here today. We believe business froze, to an extent, in the 4Q given the shocks of the rate hikes. It has thawed quite a bit if you listen to company conference calls and we have China doing their re-opening. This is inflationary. The Fed needs to stay high for 2023 to ensure inflation truly comes down, not just flattens out. All that said, that’s the elevator pitch on why be negative, right?

The reality of this market is the daily options expirations in the indices are creating havoc. The video below is a terrific description of this market right now and why it hangs on a thread, both ways! CTA’s have about $200 billion long exposure which they will sell regardless of price if we sustain below 4100 on the S&P 500 for a few days or weeks. Yikes. Not just them! Most hedge funds have taken up their net exposures a lot by covering shorts in 2023. The boat is pretty darn full of bulls seeing “resilience”.