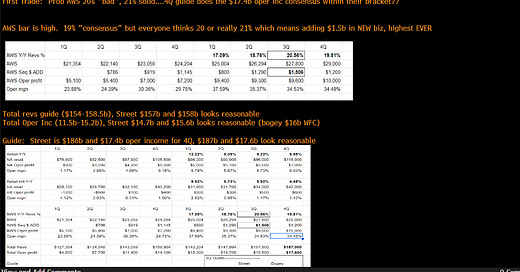

Well, no one likes to stick their neck out, do they? Amazon is about to report this evening and the concerns seem to be around higher satellite spend, tougher retail trade downs and AWS bar being too high? Also, some think the $17b EBIT for 4Q might be too high, albeit the company guides in crazy wide ranges, so need to include $17 billion. Read my analysis below where I modeled each business line and take a stab at the quarter and guide. FWIW, I think inline AWS up 20.5%+ or so and inline EBIT with inline guide would be a buy, especially if the stock dropped. What I do not know is the depreciation expense schedule which I have mentioned is a headwind for all of the big spenders. Amazon is a bit more opaque on their capital spend when they discuss. So, my summary is this heading into the report:

© 2025 Fein Luxe LLC

Substack is the home for great culture