The Ghost of Christmas Future:

$CRWD will be $WDAY in 2025. Is that bullish?

I am a numbers person. You can talk in circles about a company, their industry, their market position and products, but at the end of the day, a company is worth a net present value of their future cash flows aka discounted cash flow (DCF). The inputs for DCF are the expected cash flows (and confidence in them) and a discount rate based on interest rates and risk to those cash flows. It is true that it is easy to toggle both inputs based on your own bias. However, at any point in time, you can see what the market is willing to pay for a security and decide if it “makes sense”. Our goal today is to go back to our May 8th 2022 substack on “how to value SaaS stocks” and revisit CrowdStrike after its recent miss and stock decline. Of course, since then the discount rate has risen considerably with the Fed rate hikes and the ARR addition trajectory has “peaked” at $CRWD. So, is Crowd Strike a buy “now”? Let’s discuss!

Below:

Crowd Strike Analysis

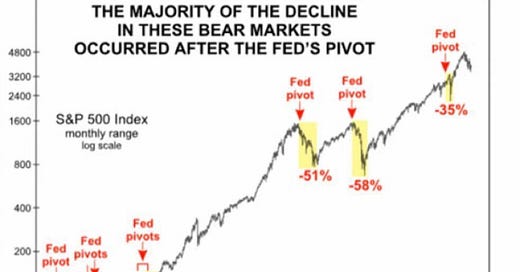

Market update: What Fed pivots historically mean to markets?

New TD Trend tool with a super high hit rate