They do not ring a bell at the top or the bottom in the markets.

At tops, investors cannot think of a single reason that stocks will go down again and every dip seems like an opportunity. Valuation discipline goes out the window.

At bottoms, investors have a laundry list of reasons to be cautious in the “near term”. Right now, many suddenly embrace the oft forgotten bond yields versus stock yields comparator. A 5%ish ten year bond with a duration in the 8s will earn you 5% per annum plus for every 1% pt drop in yields an additional 8% in price appreciation. So, if you are bearish on the economy and think the Fed cuts by 2% pts in the next few years, bonds are as attractive as they have been in ages. Frankly, every incremental dollar invested should be going into bonds, in my opinion.

Down the laundry list we have 1) two wars, 2) a slowing economy narrative, 3) the shooting some the generals like Tesla and Google, 4) still stubborn inflation, 5) the RSP (equal weighted S&P 500) is at a 52 week low and down 5.4% in 2023. It feels rightfully awful outside of a handful of stocks. The XBI is down 23% in 2023. XLU is down 17%, XLF is down 8%, XRT is down 4% and QQQ is up 29%! Do not moan and complain it is unfair! The QQQ was down 35% in 2022! If you bought the QQQ on December 31, 2021 at the close, you are still down 14%! You need context!

This is perhaps the best time in ages to be a stock picker. You do not have to fight the price to sales mania of 2021 for SaaS stocks where the only direction was up. You also are getting bargain basement fire sales in names into the mutual fund year end October 31st, which brings tax loss selling and window dressing. As we wrote about last week, you need though to swing at strikes! I saw some harsh moves in names on Friday on my screen, ABBV down 4.2%, CHTR down 10% and CVX down 7% at a 52-week low. Is ABBV cheap at 12x with no growth in EPS? No idea. Is CHTR a FCF value trap? I would think so. If CVX cannot be doing “well” with oil and refining margins during a war, is it a buy now? No clue. Those are balls passing me standing at the plate that I avoid unless I find a compelling reason to get involved. I do not shun those stocks as someone else’s problems, but rather I read the news, read the transcripts and decide if these are true over-reactions or the outlook for the stock is random at best from here. The solar group is on the floor and is likely dead and buried until rates go down. Pass. Of course, all of these have been great shorts if you had them on and solar is a big miss for me not seeing this coming given interest rates. To be fair, so is TSLA as a short if you have tried to renew a three year car lease lately and see your payments go up 30% versus the prior lease given interest rates. Musk wasn’t lying about that!

It is incredibly hard to find longs based on fundamentals and valuation right now with “confidence”. I have been trading the moves, exercising patience and stacking chips (wins) as my strategy. When I hit a rough patch, I always ask myself if I had no position on, would I take a new one in this name today. If yes, I stick, if no, I punt. I am making my lists of the best EPS this earnings season where the stocks are in reasonable valuation ranges that I can buy on dislocations, sell calls above and stick to my style. So far, it is slim pickings. Microsoft, META, AMZN, LVS, GE and ummmm, ummmm, I need to do more research, digging and thinking to expand the list. I do like this MS at 4.6% yield, 10x EPS, 2/3 recurring fee based, but so far its been no bueno and is a long term account idea for me (wait for next upturn).

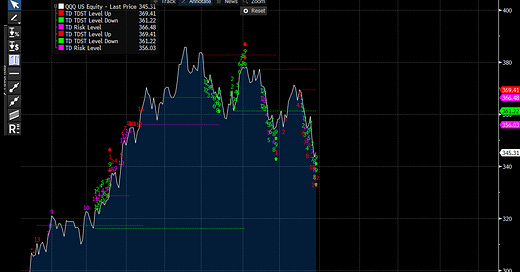

But let’s not join the end of the world mindset just yet! The 4Q rally narrative is just about gone in the market psyche. The beach ball is submerged under water and any relief can flip the switch rather quickly. Price exhaustion and give up are here. The demark TD Sequential long term indicators all flashed buy on Friday’s close: QQQ IWM and SPY (see below the red 13’s and green 9s). This type of pattern rarely happens to all three indices at once.