We wrote emphatically that the economy was not tanking after the ISM Manufacturing index showed continued contraction.

In fact, since 2022 ISM Manufacturing hasn’t often been above 50.

We wrote emphatically that the markets memory for disappointment has been cured by a rare form of amnesia.

Home Depot, Microchip, Microsoft, Tesla, Palo Alto Networks, AMD, Teradyne, Amazon, Dell, SMCI, Micron and many others have signaled to investors that business trends aren’t what was projected and yet, after a brief selling period, they find their way back to being part of any market rally.

We have witnessed the economy is weakening, the Fed is slow to react and the Yen carry trade is ending all in the month of August. Nvidia dropped 30% ($750 billion of market cap) on their Blackwell GPU delays only to be met with a chorus demand is so strong that customers will take H100s until the new products are ready. The stock has rallied 25% from its low closing price of $98.91 on 8/7/2024.

Is there a common thread, something we can learn from by these episodes? Heck, Palo Alto Networks has blown up 2-3 times (reports next week) and the analysts and investors keep pumping the stock as “this reset” is the last despite its 54x EPS for a 15% grower. Will they eventually be right? Or will they eventually give up?

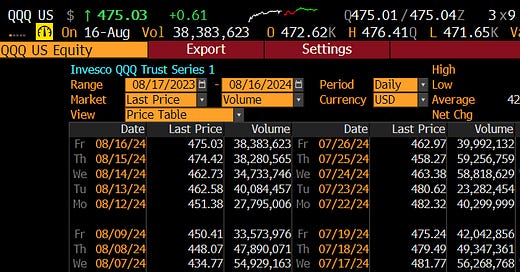

The famous saying remains true: "Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria.” At the zenith highs of QQQ $502.96 I received a text from a friend saying “I do not see anything stopping this market”. Then, Microsoft disappointed. Amazon disappointed. Tesla disappointed. AMD disappointed. SMCI and Teradyne disappointed. Pinterest and SNAP disappointed.

When the stocks are dropping, we all suddenly either rationalize holding them for the long term, the “own the good ones” strategy. Or, we look at valuation for the first time in a while and wonder at what price is the bad news discounted. The reality you ask? The market is a behavioral experiment of pain tolerance (and euphoria) similar to the saying above. You can run with a narrative on a sector, a stock or the market UNTIL it starts to prove you wrong, hurts you many days in a row or downright crushes you. Then, you suddenly see the glass half empty potentials ahead.

Let me describe it via closing prices of the QQQ since the highs.